These charts have to be updated often to include various business transactions. Adjusting entries are made for accrual of income and expenses, depreciation, allowances, deferrals and prepayments. Business transactions are recorded in a journal (also known as Books of Original Entry) in a chronological order using the double-entry bookkeeping system. You’ll need to handle payroll withholdings and then report and deposit the payroll taxes, like Social Security, to the appropriate agencies on the required dates. A payroll service provider can do all this to save you time and ensure accuracy at a reasonable cost.

Review and pay quarterly payroll taxes

If the IRS finds that you don’t have all receipts necessary for your business (from $75 and more), you can get penalized. As a result, you can experience gross income deductions before calculating the tax bracket. It’s important to send invoices right after delivering the goods or performing services. The customer is more likely to pay fast, given that the service is fresh in their minds. The weekly tasks you can assign to employees or complete yourself.

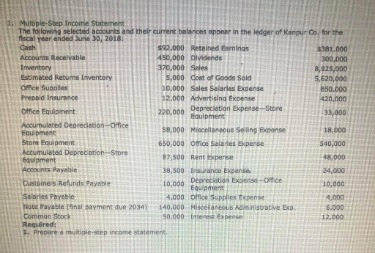

This includes recording revenue such as product sales and expenses like purchasing supplies. In such a scenario, it may be difficult to obtain the necessary funding for business expansion or complete capital expenditures. Having your accounting and bookkeeping in order will help you get external funding or bank financing for major purchases.

Plan ahead for taxes, stick to deadlines

As a direct fallout of COVID-19, more than 54% of businesses are struggling with delayed invoice payouts. When setting your financial goals, consider three distinct elements — the past, present, and future. Going full steam ahead without a financial forecast is a waste of time and money.

Doing this at least once a month makes sense because monthly bank statements aid in the reconciliation process. Reconciliation lets you verify cash flow, spot discrepancies or the gross profit missing funds, and prevent fraud. Bookkeepers record and classify financial transactions, such as sales and expenses. They maintain accurate records of daily financial activities and manage accounts payable and accounts receivable.

Keep detailed records

Additionally, business owners are likely to be unaware of the federal, local, and state laws and legal regulations required for business. US Bank research confirms that cash flow issues are the number one reason for the closure of almost 82% of small businesses. The failure rate of sole proprietorships is even lower, according to the same study.

Without them, it’s nearly impossible to make informed decisions about your business’s financial health. Tracking your AR, usually with an aging report, can help you avoid issues with collecting payments. Understanding your AR can also help you set efficient credit terms for your customers. When planning how much it takes to the rules for deducting business expenses on federal taxes keep a small business running, the numbers can get complicated. Devise an accurate system of expenses and regular obligations so you know exactly the minimum income you need every month.

- Make smarter decisions and run a more efficient business by leveraging your business data.

- Do an inventory analysis to determine the value of items not sold.

- It’s helpful to create income statements because they compare the current numbers to the budget, but also the historical performance of the business.

- You can give your tax preparer accrual-basis financial statements and they can very easily convert them to the cash basis for your tax return,” he said.

- There are many easy programs to use for small business bookkeeping.

Accurate and up-to-date bookkeeping and accounting increase the odds of a small business succeeding. Accounting software can streamline your bookkeeping process and make your financial management more efficient. It’s useful for business owners looking to save time and avoid common accounting errors.

Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Note that you’ll need to pay some payroll taxes, such as FICA taxes, to the IRS monthly or sem-weekly, depending on the amount you withhold. However, for FUTA taxes, deposits are typically due quarterly, and cashing old checks you’ll file your FUTA return (Form 940) annually. Cash flow management is critical and includes forecasting how much cash you will need in the coming weeks and months. It will help you reserve enough money to pay bills, employees, and suppliers.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. At the end of your fiscal year, you will look at this account again to determine what receivables you will need to send to collections or write off for a deduction. Put this on your to-do list once you get a social security number as a sole proprietor or an Employer Identification Number (EIN) as a professional service firm founder. When companies use bank finance to fund their daily operations, they often struggle to pay back the high-interest debt.