Companies generally pay these in cash directly into the shareholder’s brokerage account. When the small stock dividend is declared, the market price of $5 per share is used to assign the value to how to calculate vacation accruals free pto calculator the dividend as $250,000 — calculated by multiplying 500,000 x 10% x $5. However, it’s not a good look for a company to abruptly stop paying dividends or pay less in dividends than in the past.

General Business Overview

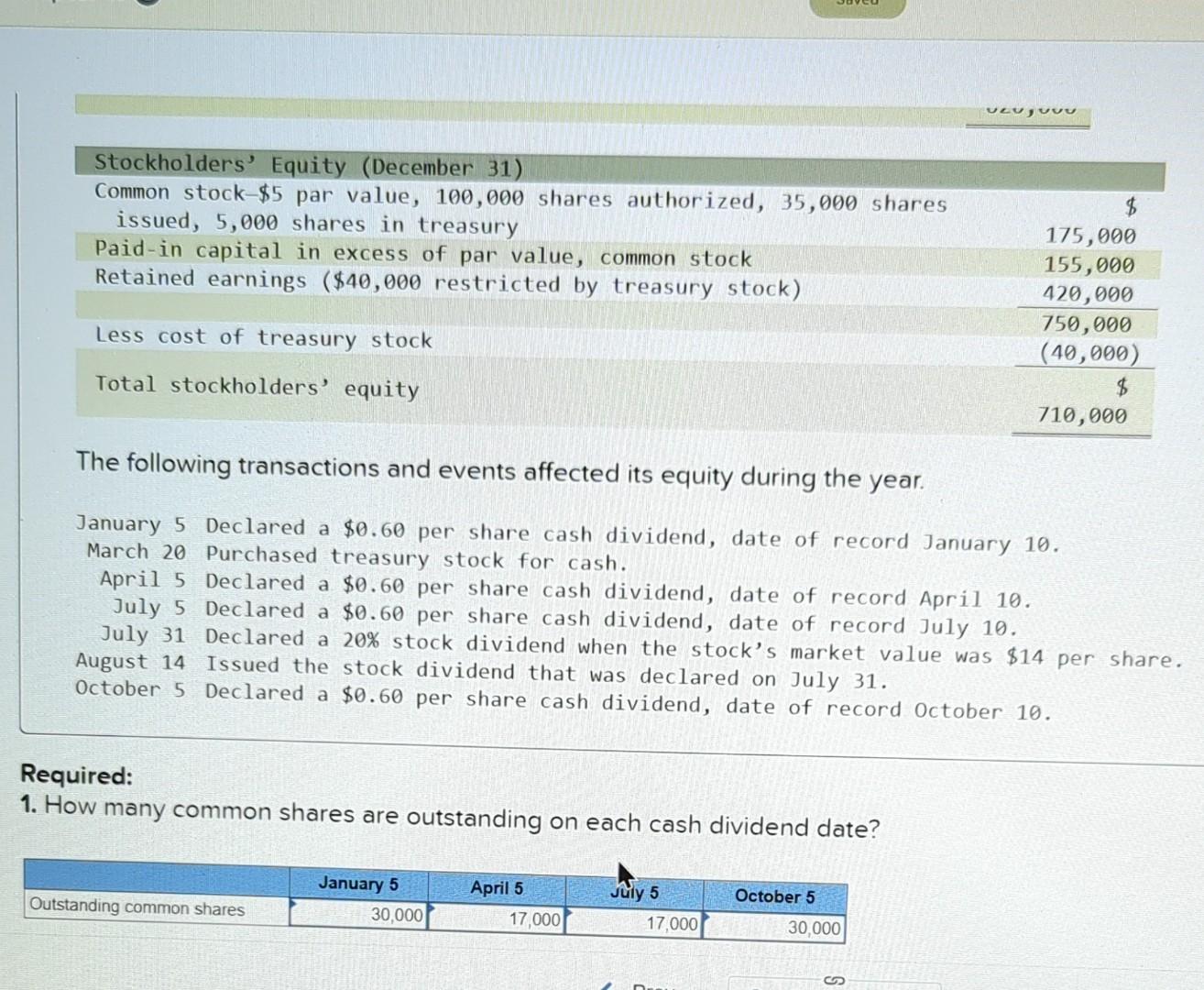

Upon payment, the company debits the dividends payable account and credits the cash account, thereby eliminating the liability by drawing down cash. Stock dividends, on the other hand, involve the distribution of additional shares to existing shareholders in proportion to the shares they already own. This type of dividend does not result in a cash outflow but does affect the components of shareholders’ equity. When a stock dividend is declared, the retained earnings account is debited for the fair value of the additional shares to be issued. Upon distribution, the common stock dividend distributable account is debited, and the common stock account is credited, reflecting the issuance of new shares. Stock dividends dilute the ownership percentage but do not change the total value of equity held by each shareholder.

Congrats! You will now receive future alerts from us.

Until such a dividend is declared and paid to the concerned shareholder, the amount is recorded as a dividend payable in the current liability on the company’s balance sheet. The income statement, which reports a company’s revenues and expenses over a period, is not directly affected by dividend transactions, as dividends are not considered an expense but a distribution of earnings. However, the lower retained earnings figure indirectly indicates to investors and analysts the portion of profit that has been distributed as dividends. Property dividends are distributions of assets other than cash or stock to shareholders. These can include physical assets, such as real estate or equipment, or financial assets like securities from another company. Property dividends are less common than cash or stock dividends and are typically issued when a company wants to dispose of certain assets or when it lacks sufficient liquid resources.

The Accounting Treatment of Dividends

This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors. In this situation, the date the liability will be recorded in Your Co.’s books is March 1 — the date of the Board’s original declaration. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

SOBO Dividend Payments

Investors need to know if the tax break will continue due to the significant disparity. Pursuing an investment strategy is only advantageous if one of the major advantages would not be taken away.However, even if congress passes the Buffett Rule (which is very likely), it would not affect most investors. You are in good shape if you get a high yield (above 5%) and the payout ratio is low. One choice is to reinvest profits into the company’s growth by acquiring better equipment, marketing, and research and development. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of financial products.

First Majestic Silver Announces Financial Results for Q3 2024 and Quarterly Dividend Payment

Any net income not paid to equity holders is retained for investment in the business. On the payment date, the following journal will be entered to record the payment to shareholders. On the date that the board of directors decides to pay a dividend, it will determine the amount to pay and the date on which payment will be made.

For example, if you purchase Natural Gas Inc. at $10 per share that pays $1 per share yearly, your ROI is 10%. Yield-seeking investors might be attracted to dividend stocks regardless of the sector or industry. Still, it is essential to remember that the same due diligence is required when assessing these companies. For example, though the income you gain from dividends qualifies for a credit, your labor does not. The United States is alone in this sense among industrialized countries- it taxes the money you make overseas even if you already paid income tax there.

- The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account.

- A lower-priced stock tends to attract more buyers, so current shareholders are likely to get their reward down the road.

- Since shares of some companies can change hands quickly, the date of record marks a point in time to determine which individuals will receive the dividends.

- ABC Ltd. has an equity share capital of $1 million, consisting of 1 lakh shares with a face value of $10 each.

- This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research.

On this date, eligible investors receive their share of the declared dividend as long as they are included on the record. A payment date, also known as the pay or payable date, is the day on which a declared stock dividend is scheduled to be paid to eligible investors. Note that the stock price may fall on the payment date to reflect the dividend payment even if it has not been actually credited to investors at that point in time. The payable date refers to the date that any declared stock dividends are due to be paid out to shareholders of record as of the ex-date. Investors who purchased their stock before the ex-dividend date are eligible to receive dividends on the payable date. It’s important to note that if the stock is sold on or after the ex-dividend date, the investor will still get paid the next scheduled dividend.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Company-operated DRIPs are usually commission-free because they bypass a broker. This feature is particularly appealing to small investors because commission fees are proportionately larger for smaller purchases of stock. As a practical matter, the difficulty of reversing a declaration makes the payment unavoidable for a going concern and the liability treatment is appropriate. Many countries also offer preferential tax treatment to dividends, treating them as tax-free income.

Information relating to the proposed transaction can be found on the Company’s website. The final determination of the tax attributes for dividends each year are made after the close of the tax year. The final tax attributes for 2024 and 2025 dividends are currently expected to include a combination of ordinary taxable income and qualified dividends and may include capital gains and return of capital. When the declaration is made, the company will determine a record date, also known as the date of record, which indicates the deadline for a shareholder to be recorded on the books in order to qualify for the dividend. Usually, this also coincides with who the company issues such material as financial reports and proxy statements. The pay date for the dividend may be up to one month after the ex-dividend date passes.